All members, students, and firms should renew their registration by May 31, 2024, for the 2024 - 2025 registration year.

Creating Human Connections, Empowering HR, Inspiring Excellence

The world of work has undergone significant transformations in recent years, with further disruptions on the horizon fueled by labour challenges, talent scarcities and the impact of AI on the workplace.

Year after year, HR has been called upon to respond to these challenges. This year is no exception. Businesses are looking for resilient, strategic, skilled and regulated HR leaders to navigate the evolving workplace and future.

The great news is that HRPA is here for you. With our expanding membership value bundle – and access to top-tier professional guidance, networking opportunities and programs, HRPA is driving the next level of collaboration, impact and success. We do this by equipping our members and students with the latest tools and practical resources, while ensuring the highest standards. We do this by creating human connections, empowering HR and inspiring excellence.

This is HR’s moment – HRPA is ready to deliver for you and support leadership in workplaces across Ontario, powering the future of work.

This is your career, your profession, your HRPA.

Renew today! Deadline to renew your membership is May 31, 2024.

Unless registrants notify the HRPA that they would like to opt out, they will, if they renew on or before May 15, 2024, be automatically eligible to earn one entry into the HRPA Renewal Campaign Contest. Contest rules and regulations apply. To opt out of the HRPA Renewal Campaign Contest, please email contest@hrpa.ca and include your full first and last name.

No purchase necessary. Starts April 2, 2024, at 10:00 a.m. ET and ends May 15, 2024, at 11:59 p.m. ET. Open only to residents of Canada (excluding Quebec) who, at contest start, are a current registrant of the Human Resources Professionals Association. Minors must have parent/guardian consent to participate. 10 prizes available, each consisting of one (1) pair of wireless headphones (ARV $329 CAD each pair). Odds depend on number of eligible entries. Math skill-testing question required.

Your Membership Value Bundle

It has never been more rewarding to be a member. Our expanding member value bundle is now offering even greater benefits for your membership investment.

NEW: 3 FREE micro-conferences, valued at over $510.

NEW: Member Resources Hub, with valuable new tools and resources

$480 in savings with FREE Power Lunches

-

- NEW: 3 FREE micro-conferences, valued at over $510.

- NEW: Member Resources Hub, with valuable new tools and resources

- $480 in savings with FREE Power Lunches

- Dozens of FREE Chapter Professional Development sessions & member-exclusive savings in workshops, certificates programs!

- Special HR legal updates

- Professional guidance and standards

- Network of over 23,000 like-minded HR professionals – the largest network in Ontario

- Hire Authority, member-exclusive job board

- Surveys, latest research and reports

- Online communities

- Mentorship Program

- HRPA advocacy

- Exclusive member perks, savings, and discounts on home plus access to online learning hubs and knowledge exchange platforms. View HRPA Member Benefits

- And much more!

Renewal Fee Schedule

Your renewal dues are based on your member or student registration class and place of residence.

If your member or student registration class changes after your renewal invoice has been generated, we unfortunately cannot adjust your invoice, but the change will be reflected in your renewal the following year.

Click below for fee table that would apply to you.

| 2024-2025 Renewal Dues by Class | In Ontario | HST (13%) | Total |

|---|---|---|---|

| CHRE | $550.14 | $71.52 | $621.66 |

| CHRL | $550.14 | $71.52 | $621.66 |

| CHRP | $393.26 | $51.12 | $444.38 |

| Practitioner | $466.40 | $60.63 | $527.03 |

| Allied Professional | $292.56 | $38.03 | $330.59 |

| Student | $100.00 | $13.00 | $113.00 |

| Retired status (all classes) | $100.00 | $13.00 | $113.00 |

Registrants living in a Canadian province other than Ontario should calculate the tax in their respective province. Registrants residing in a country other than Canada do not have to pay a goods and services tax.

| 2024-2025 Renewal Dues by Class | Outside of Ontario |

|---|---|

| CHRE | $449.44 |

| CHRL | $449.44 |

| CHRP | $292.56 |

| Practitioner | $371.00 |

| Allied Professional | $197.16 |

| Student | $100.00 |

| Retired status (all classes) | $100.00 |

If you require financial assistance due to unemployment, reduced hours/salary, parental leave, contract work, or retirement, we can help.

Simply apply for the Renewal Dues Assistance Program (RDAP) to have your dues reduced. For more details, please click here to download the form and submit to renewal@hrpa.ca once completed.

Please submit your RDAP application by May 15th, so we can ensure it is processed prior to the May 31st renewal deadline.

While May 31st is the renewal deadline, you have a four-month grace period where you can still renew, but the following late fees will apply:

- Students: $20

- Renewal under the Renewal Dues Assistance Program: $50

- Members: $100

If you missed the renewal deadline due to extenuating circumstances, the late fee may be waived. To request a waiver of the late fees, simply submit the Late Fee Waiver Request Form to renewal@hrpa.ca.

If you do not renew or resign by May 31st, your registration becomes subject to suspension and possibly revocation, in accordance with the Registered Human Resources Professionals Act, 2013 and the By-laws.

If you hold a designation and are considering not renewing or resigning, we strongly encourage you to first review our Reinstatement and Re-Achievement Policy, so you are aware of the process involved should you wish to rejoin the HRPA in the future.

Frequently Asked Questions

Renewing your registration is easy. Just follow the steps below. For best results, we recommend using a Chrome browser.

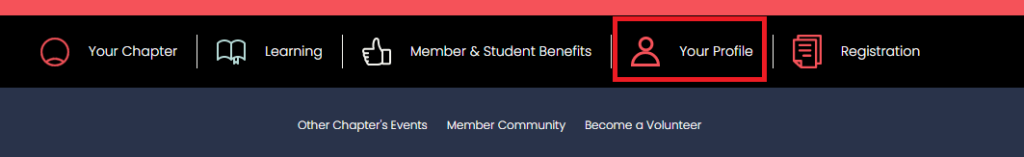

1. Click here to access your Dashboard.

- Enter your username and your password to log in.

- Your username is the same email address where you normally receive email correspondence from us.

- If you need assistance in logging in, please click here for Sign-In help.

- Click on ‘Your Profile’ to access the Dashboard

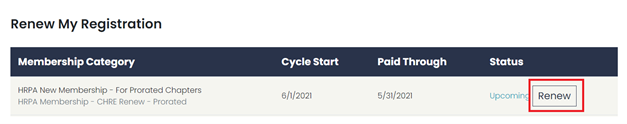

2. Click on the ‘Renew’ button to access the renewal application.

3. Complete the registration form

- You will be presented with a series of questions.

- When all sections are COMPLETE click NEXT.

- You will be presented with an overview of your renewal dues before proceeding to the payment page. If any of the information on your renewal invoice is incorrect do not proceed, please contact the Office of the Registrar at renewal@hrpa.ca for assistance.

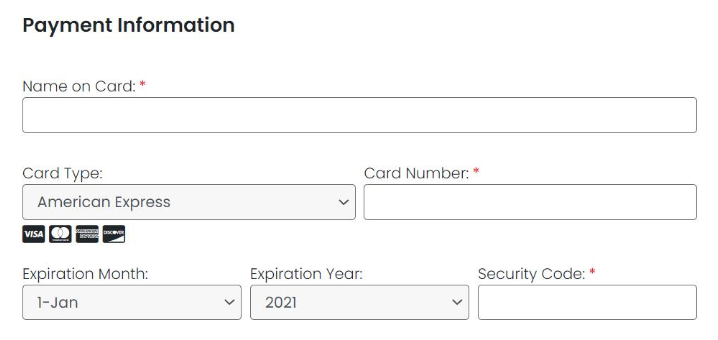

4. Enter your credit card information and complete the payment information form.

- Click “Submit Order” to complete your payment.

- Please note that the HRPA no longer accepts payment by cheque. We apologize for any inconvenience.

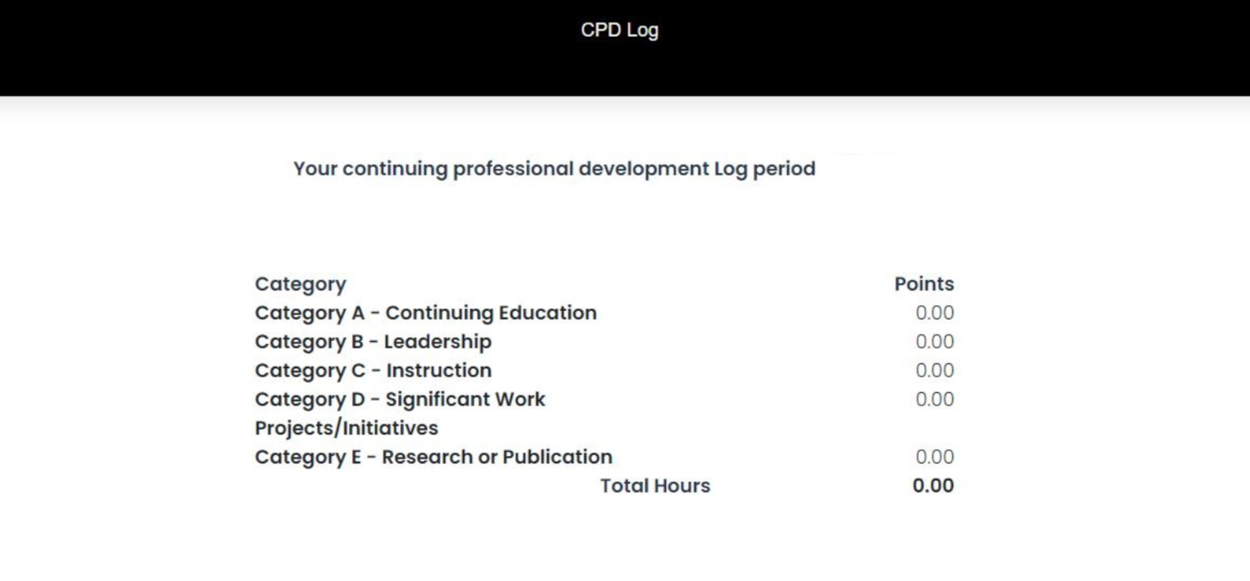

5. Submit your CPD logs if required, by clicking “Continuing Professional Development“

- CHRP, CHRL and CHRE members are required to obtain 66.67 hours of professional development activities for every three-year CPD cycle. If you are due to submit your CPD hours this year, please submit it by May 31st.

Once your renewal has been completed, we will email you your Renewal Confirmation, including a copy of your renewal receipt for your records. Please note that it may take up to 24 hours to receive your Renewal Confirmation and copy of your renewal receipt after you’ve submitted your renewal registration.

HRPA offers lower renewal dues for registrants who have retired. For designated registrants, retired status allows them to keep their designation but without being subject to the continuing professional development requirement as long as they put ‘retired’ or ‘ret’ behind their designations. Registrants whose designations have been retired are no longer eligible to vote in elections for the HRPA’s Board of Directors but otherwise continue to enjoy all the same rights and obligations as other registrants.

There are some things you may want to consider before applying for retired status.

- If you ‘retire’ from a company, but continue to practise HR either full-time, part-time, on occasion, or pro bono, you are not eligible for retired status.

- Registrants applying for retired status are permitted to work a maximum of 15 hours a week in a non-HR capacity.

- If you exit the workforce entirely and do not want to keep the right to use your designations but wish to remain registered with the HRPA, you may apply for retired dues and resign your designations (and be placed in a non-designated registration class, such as Practitioner).

- If you would like to simply resign your registration with the HRPA once you have retired, please complete the Resignation Form and submit it to renewal@hrpa.ca.

Note that to maintain the right to use your designations, even under the retired status, you must remain a registrant of HRPA.

Please complete the Renewal Dues Assistance Program request form indicating that you are applying for retired status and send it back to us by mail or email to renewal@hrpa.ca.

CHRP, CHRL, and CHRE members of the HRPA must meet the CPD requirement and submit their log every three years. The deadline for logs is always May 31 of the year it is due. For more information, please click here.

If you do not submit your CPD log, your registration becomes subject to suspension and possibly revocation, in accordance with the Registered Human Resources Professionals Act, 2013 and the By-laws.

Your registration status is posted on our Public Register. To avoid having a registration status of “Suspended” or “Revoked” appear on our public register, you must submit a completed Resignation Form to renewal@hrpa.ca. Please note that the HRPA cannot accept resignations over the phone.

Registration dues are non-refundable.

If you hold a designation, we encourage you to review our Reinstatement and Re-Achievement Policy before you resign so you are aware of the process that is involved should you decide to rejoin the HRPA in the future.

Suspension means that you have temporarily lost the rights and privileges relating to your registration, including the right to use any designations granted to you by the HRPA.

If you have not renewed or resigned by May 31st, you will receive a 30-day notice via email about your impending suspension on July 15th at 5 pm.

Suspension takes place on July 15, 2024, at 5 pm, if you have not renewed or resigned.

If you are suspended, we will issue you a Notice of Suspension and Impending Revocation. This notice confirms that your suspension has taken effect and provides you with 60 days’ notice that your registration is pending revocation.

Revocation occurs if you have not renewed or resigned by October 1, 2024, at 5pm.

If you have not renewed or resigned by that date, you will be revoked and we will issue you a Notice of Revocation, which is sent by email only.

Revocation means that you have officially lost all the rights and privileges relating to your registration, including the right to use or advertise any designations granted to you by the HRPA.

If you are revoked and held a designation and would like to rejoin the HRPA, please review our Reinstatement and Re-Achievement Policy.

The HRPA accepts payment through the following credit cards via our online renewal system:

- VISA

- MasterCard

- American Express

Once the payment is processed and your renewal is complete, a receipt and registration card will be sent to you via email.

Alternatively, you can print your receipt by accessing it through My Transactions in the Dashboard.

If you have not renewed your registration and would like to print a copy of your invoice, please follow these steps:

- Click here to access your Dashboard. Enter the e-mail address you provided to the HRPA and your password. If you need to retrieve your password, use the Sign-In Help.

- From your Dashboard, click the “Renew” button and go through the renewal process, clicking “Next” to complete each section until you reach the payment section.

- In the payment section, select “Click here to print your renewal invoice” to view the details and print the invoice.

If you currently hold a CHRP, CHRL, or CHRE designation and are unable to obtain the required 66.67 CPD hours during your CPD period, you may submit a request for an extension by completing the CPD Request for Extension Policy. All extension requests must be submitted prior to the CPD submission deadline (May 31st), but no earlier than 6 months prior to when the CPD log is due.

Please note extensions can be granted by HRPA for the following reasons:

- On parental/maternity leave

- Experiencing prolonged illness

- Experiencing unemployment

To apply for an extension, please update your CPD log with how many hours you have accrued to date, provide supporting documentation to validate your extension request (e.g., a doctor’s note), complete the CPD Extension Request Form, and submit all of these via email to registrar@hrpa.ca.

Yes. As required by the HRPA’s By-laws, your business address and telephone number will appear on the HRPA’s public register. If you are an independent practitioner/consultant who operates out of your home, your home address becomes your business address.

Registrants who were granted their CHRP or CHRL designation during the registration year will be charged the designated renewal dues.

If you need help with the renewal cost due to the financial impact of life events such as unemployment, we encourage you to consider applying for the Renewal Dues Assistance Program (RDAP).

If you would like to change your chapter, please send your chapter transfer request to renewal@hrpa.ca. Changing your chapter affiliation does not change your renewal dues, so you can go ahead and renew your registration before your chapter affiliation has changed.

As part of your renewal, you will be asked a series of mandatory self-reporting questions.

If you answer ‘Yes’ to one or more of the self–reporting questions, a staff member from the HRPA will contact you to confirm your answer and provide you with information on how to proceed. Please note that you can complete your renewal in the meantime – answering yes to one or more of the self-reporting obligations does not prevent you from renewing your registration with HRPA.

Please follow the instructions below:

- Click here to access your Dashboard. Enter the e-mail address you provided to HRPA and your password. If you need to retrieve your password, please use the Sign-In Help.

- From your Dashboard, click “Edit My Contact Information” and update the necessary information. Click “Save.”

Email is the HRPA’s primary mode of communication, so please ensure you keep your email/username up-to-date and check your inbox, including your junk mail, regularly for communications from the HRPA.